What is Year-Over-Year (YOY)?

The term year-over-year describes the process of comparing financial data for a certain timeframe with the corresponding period of the previous year.

This process is used by investors, stock market analysts, economist, and other professionals to examine performances and trends.

Techopedia Explains the Year-Over-Year Meaning

The most accurate year-over-year definition is comparing a set of financial data with the figures achieved during the same period in the previous year. It can be shortened to YOY.

This type of analysis can illustrate whether important metrics, such as inflation or profitability, have increased or decreased over the past 12 months.

For example, investors may want to see whether the sales revenue achieved by a company during the second quarter of 2024 was better than the same period in 2023.

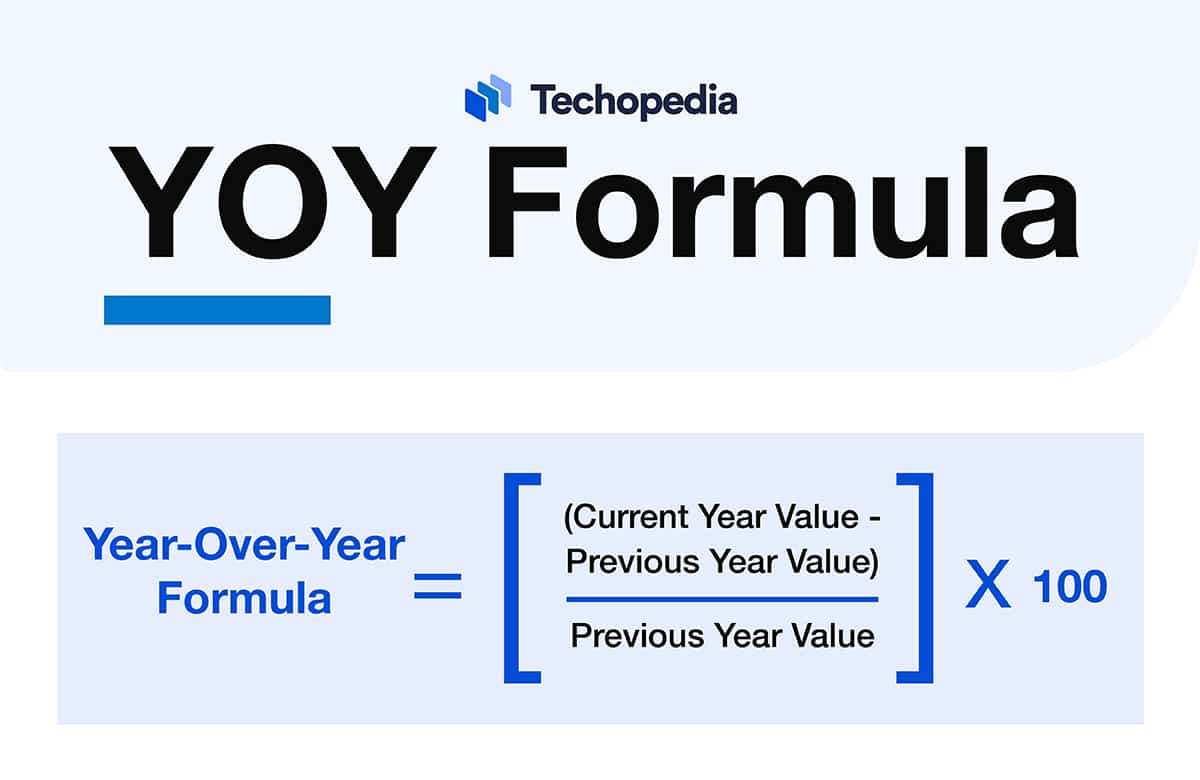

YOY Formula

There is a simple calculation that can be used to reveal the year-over-year movement.

You take the current year’s revenue and subtract the previous year’s figure.

You then divide this number by the previous year’s revenue and multiply the result by 100 to get the percentage growth.

How to Calculate YOY

For this step by step example, we’ll take a look at comparing year-over-year sales revenue.

- Establish the current revenue figure. For example, this could be the amount generated in the first quarter of this year (2024).

- Find out how much revenue was made in the corresponding period of the previous year. You need to ensure it was the same quarter in 2023.

- Work out the difference. Subtract last year’s revenue from this year’s figure. The result is the amount of extra money generated (if, indeed, it rose).

- You divide the figure from step three by last year’s revenue figure, before multiplying the result by 100. This gives you the percentage growth.

Common YOY Financial Metrics

There are a number of financial metrics that can be used to compare companies on a year-over-year basis.

YoY Economic Indicators

Of course, year-over-year analysis can also be used to look at wider economic indicators.

This shows how much the price of goods and services have risen over certain periods. It’s critical for both individuals and businesses.

Showing how much unemployment has gone up (or down) over the past year is another vital indicator of a country’s financial prospects.

This means looking at whether people are saving more – or less – today than they were a year ago. This shows if they’re getting wealthier.

Common Uses of Year-Over-Year

So why do people look at year-over-year?

Well, one of the most common uses of this analysis is when comparing the results of publicly listed companies. Such businesses are required to give details of their financial performance and these figures are often analyzed on a quarterly, half yearly, and annual basis. This can enable investors and stock market analysts to gauge whether a company is performing better or worse than expected.

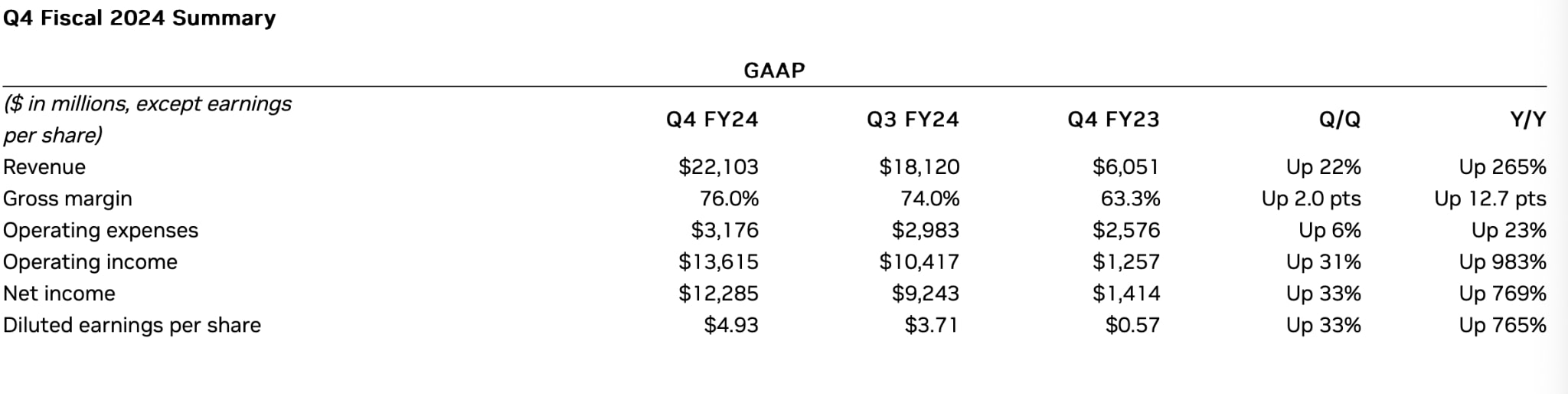

Let’s take the example of Nvidia, a US technology company, and the publication of its results for the fourth quarter ending 28 January, 2024.

It revealed revenue of $22.1bn was achieved in this period, compared to $6.1bn during the fourth quarter of 2023. This represented a year-over-year increase of 265%.

Source: Nvidia

Year-Over-Year Example

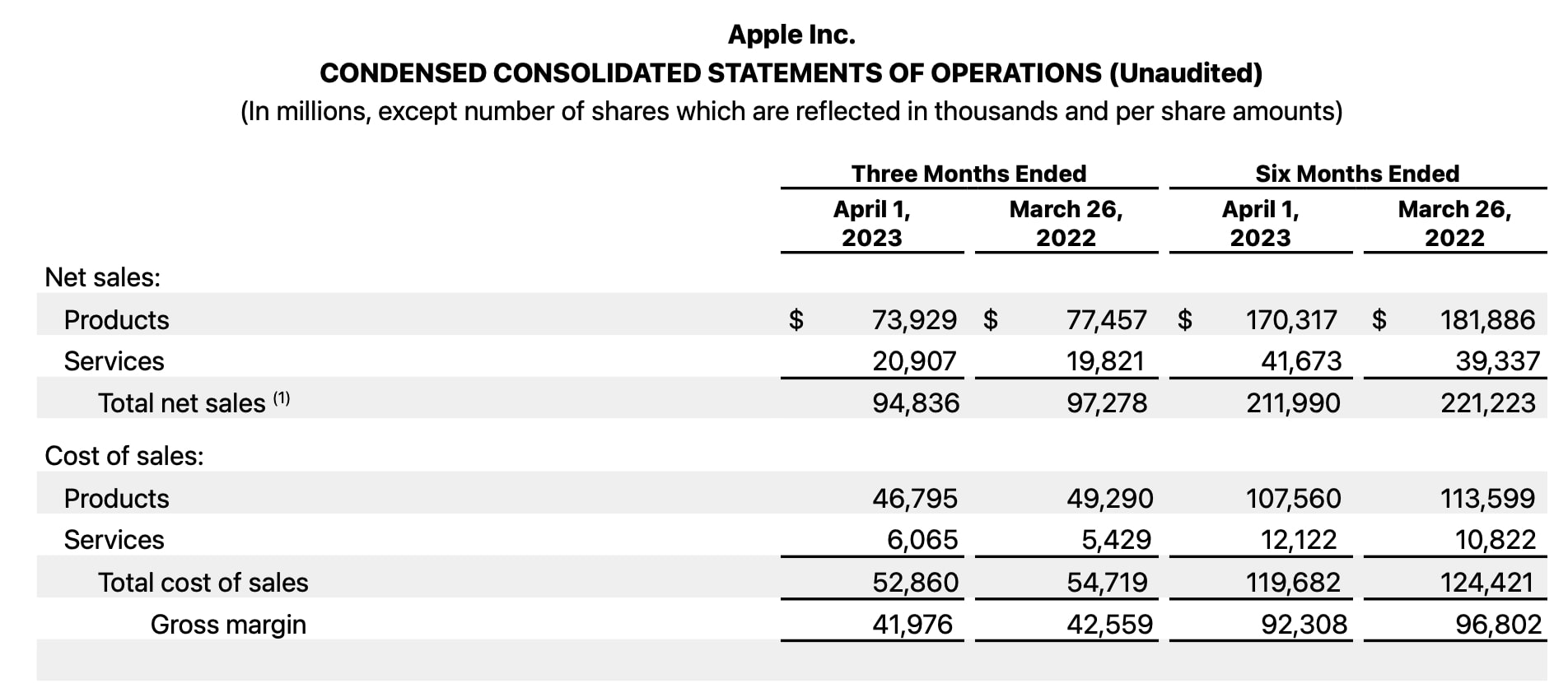

Let’s take a look at another example. This time it’s tech giant Apple‘s financial results and how senior management compared them with previous periods.

In its news release for the quarter ending 1 April 2024, the company highlighted a year-over-year comparison when describing its sales. It stated: “The Company posted quarterly revenue of $94.8 billion, down 3 percent year over year, and quarterly earnings per diluted share of $1.52, unchanged year-over-year.”

Luca Maestri, Apple’s CFO, added in a statement: “Our year-over-year business performance improved compared to the December quarter, and we generated strong operating cash flow of $28.6 billion while returning over $23 billion to shareholders during the quarter.”

Apple, along with other quoted companies, will often enable you to make year-over-year comparisons for different time periods.

Source: Apple

Pros and Cons of Year-Over-Year Analysis

Here we take a look at the various positives and negatives of using year-over-year as a form of analysis.

Pros

- Provides a great snapshot of how a company is performing

- It’s a simple calculation

- The result is easy to understand as a percentage

Cons

- Headline figures may not take into account specific factors

- It can be very simplistic

- There’s a risk of drawing inaccurate conclusions

The Bottom Line

When people talk about the year-over-year meaning they are referring to the comparison with what has been achieved in the past. It can be a very good way of identifying broad economic – and company specific trends – and a useful decision making tool for investors.

A year-over-year comparison can be a useful way to illustrate whether a company is generating more profit than it was last year.

However, it’s important that such a metric is not used in isolation. There are likely to be a number of factors that influence a year-over-year comparison.

For example, the company may have been hit with a one-off cost that has skewed the figures. If you consider all such various metrics then you will have a more accurate result.