What are ISO 20022 Coins?

An ISO 20022 coin is a digital currency that adheres to the international standard ISO 20022 for electronic data interchange between financial institutions.

This standard, managed by the Society for Worldwide Interbank Financial Telecommunication (SWIFT), allows for more streamlined and informative communication between banks.

In the context of cryptocurrencies, ISO 20022 compliance can enable easier integration with traditional financial systems, potentially accelerating the adoption of digital currencies.

History of ISO 20022 Coins

The development of the ISO 20022 standard began in the early 2000s with an aim to replace the existing MT/ISO 15022 messages that were used in SWIFT messaging, the new format, referred to as MX, promised richer data and greater flexibility.

International banking system migration to ISO 20022 was planned in several stages, with high-value payments in the European Union being the first to transition in November 2022. The U.S. Federal Reserve planned a full migration by November 2023, with the old MT/ISO 15022 system being phased out by 2025.

In the context of cryptocurrencies, compliance represents a significant step towards bridging the gap between traditional finance and emerging digital assets.

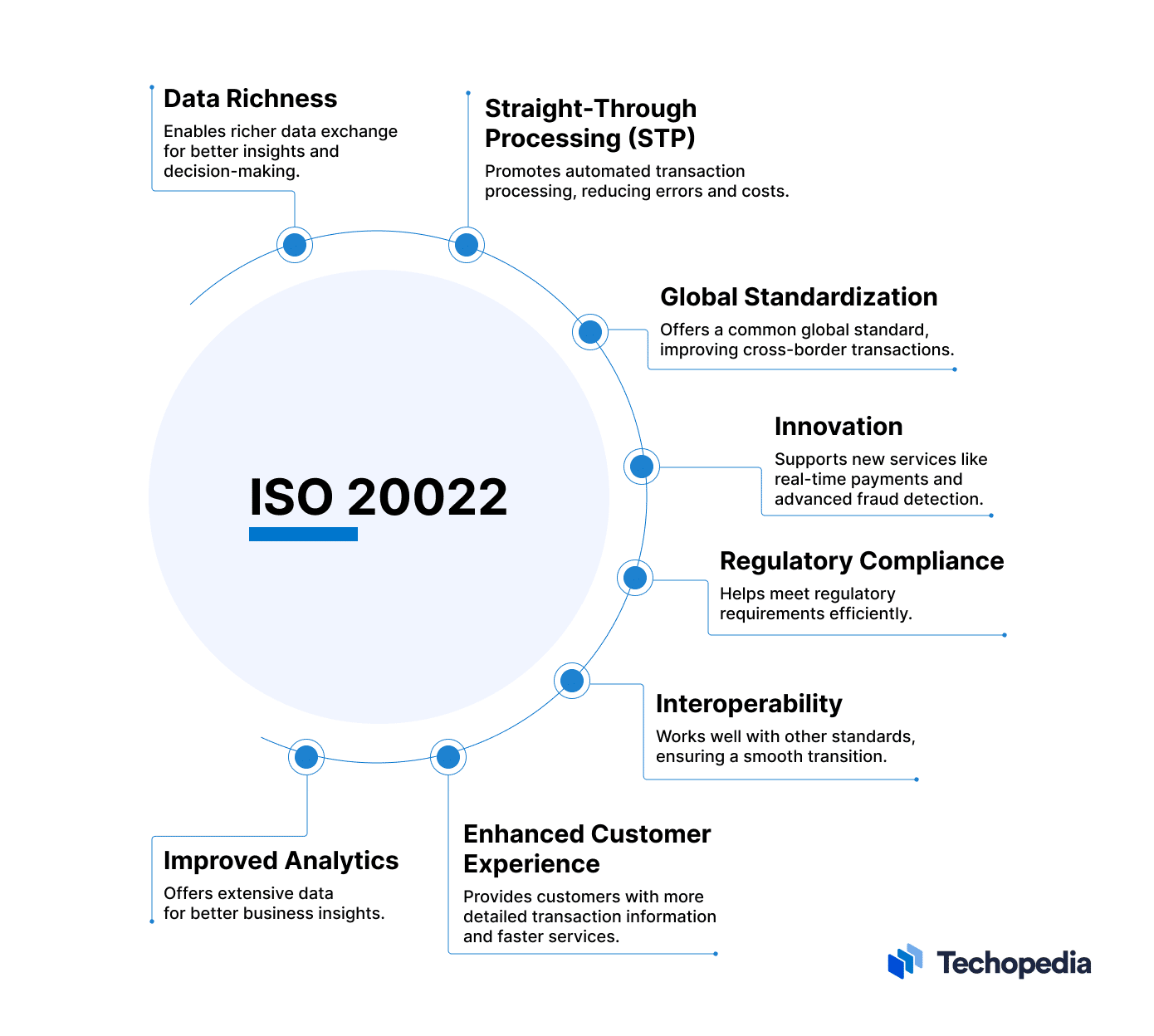

Why are ISO 20022 Coins Important?

ISO 20022 coins are essential for various reasons. First and foremost, they provide a standardized communication system, which ensures smoother integration with existing banking and financial services.

They also open up opportunities for promising cryptocurrencies like XRP and stellar lumens (XLM), designed for banking and central bank digital currencies (CBDCs), to play vital roles in global financial settlements.

This standard might also pave the way for popular cryptocurrencies like bitcoin (BTC) and ether (ETH) to be integrated into the SWIFT system, radically altering how crypto and fiat currencies coexist in the future of the digital economy.

How Do ISO 20022 Coins Work?

ISO 20022 provides a set of rules and a central dictionary that facilitates rich data exchange, including modeling methodology and XML design rules. Coins that comply with ISO 20022 must adhere to these specific standards.

For example, Ripple’s poll-based consensus method complies with the standard, allowing nearly instantaneous consensus while retaining network decentralization.

This increased speed and reduced transaction cost could lead to substantial synergy between XRP and SWIFT, leading to increased bullish sentiment among XRP holders.

Advantages and Disadvantages of ISO 20022 Coins

Exploring the advantages and disadvantages illuminates the huge opportunity this presents for the mainstream adoption of cryptocurrencies, offering to herald in a new era of fiat and digital interoperability.

Advantages

- Improved Processing Time and Accuracy: ISO 20022’s structured fields enable faster and more accurate validation.

- More Efficient Sanctions Checking: Reduces processing time by looking for specific information in defined fields.

- Reduced Risk and Maintenance Costs: Standardizing formats reduces risk and cost overhead.

- Enhanced Customer Understanding: Greater data can lead to improved product development that better meets customer needs.

- Fraud Reduction: Specific data points within the message can help identify potentially fraudulent transactions.

Disadvantages

- Technology Barriers: Some banks may lack the technology to migrate to the standard, leading to additional costs.

- Potential Loss of Information: Truncation of the message fields may result in the loss of important information, affecting areas like financial crime detection.

The Bottom Line

ISO 20022 coins represent a significant evolution in the financial landscape, bridging traditional banking with the world of cryptocurrencies.

The standard offers numerous advantages, including improved processing time, fraud reduction, and the possibility of understanding customer behavior better.

However, its successful implementation requires overcoming technological barriers and ensuring that the rich data provided by the standard is fully utilized.

The future of coins appears promising, and its full potential may be realized as the standard continues to evolve and find its place in the constantly changing financial ecosystem.