What is Free Float?

The most accurate definition of free float is the number of shares in a company that can be traded freely on the stock market.

It refers to those owned by many different shareholders – and doesn’t include restricted or locked-in shares held by company managers or major institutions.

Key Takeaways

- Free float are the shares in a company that can be freely traded on the stock market.

- It doesn’t include shares that are held for the long term by major shareholders.

- Potential investors can see which stocks may be ignored by institutional investors.

- Companies can increase and decrease the free float.

- Stocks with a smaller float tend to be more volatile.

How Free Float Works

A free float refers to the number of a company’s shares that are freely available for investors to trade on the stock market. This is an important financial metric as it enables a potential investor to gauge how liquid a stock is likely to be before becoming a shareholder.

Basically, the larger the free float, the less volatile a stock is likely to be. Conversely, companies with small floats tend to have a higher volatility.

Companies must have a certain amount of free float when they want to list on a stock exchange through an initial public offering (IPO).

In 2021, the UK’s Financial Conduct Authority lowered the minimum free float levels from 25% to 10% as part of a package of measures to reduce barriers to listing.

At the time, Claire Cole, the FCA’s director of market oversight, said: “We need to act to meet the needs of an evolving marketplace.”

Separately, the free float market cap refers to the way of calculating the market capitalization of a particular company based on the number of freely tradable shares. The sum would be: the company’s share price multiplied by its free float.

In the next section, we’ll show you how to calculate the free float.

How to Calculate Free Float

Calculating the free float involves taking the total number of shares issued by a company and subtracting the restricted or closely held shares. Restricted shares are often held by company executives and can’t be transferred until certain conditions have been met.

An example of closely-held shares, meanwhile, includes stock owned by major long-term shareholders.

Free Float Formula

This is a simple formula to calculate the overall free float of a company.

It’s also possible to establish the free float percentage. This is an expression of how many outstanding shares can be traded freely by investors.

This percentage would be achieved by dividing the free float by the number of shares outstanding and then multiplying this figure by 100.

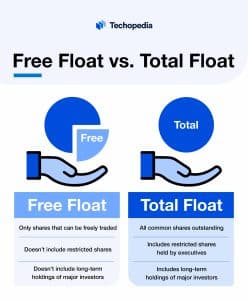

Free Float vs. Total Float

Here we take a look at the differences between a company’s total float and its free float. As you can see, the main ones relate to how many shares can be freely traded.

Free float

- Only shares that can be freely traded

- Doesn’t include restricted shares

- Doesn’t include long-term holdings of major investors

Total float

- All common shares outstanding

- Includes restricted shares held by executives

- Includes long-term holdings of major investors

How to Increase or Decrease the Free Float Volume

A company’s free float doesn’t have to be set in stone. It can change based on decisions taken by the management team. For example, the free float stock can be increased by the company issuing new shares or carrying out a stock split.

Conversely, the free float can be reduced if the company decides to buy back its own shares on the stock market.

Free Float Example

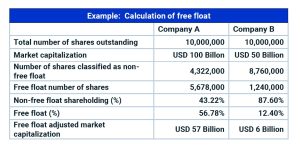

The following is an example from MSCI that illustrates a company’s total number of outstanding shares and how the free float is calculated.

Free Float Pros and Cons

Pros

- Shows investors the potential liquidity of a company’s stock

- Illustrates which are held by institutional investors

- Reveals how many shares you can buy and sell at any given time

Cons

- Free float often doesn’t include the holdings of major long-term shareholders

- Companies must offer a minimum free float when they list on stock markets

- The free float can increase and decrease due to management’s decisions

The Bottom Line

The free float meaning is the number of shares in a company that can be publicly traded on a stock market. It excludes the locked-in shares of company managers and those held by major institutions with a controlling interest in the stock.

Free float is a very useful metric for investors to consider as it reveals information such as the likely liquidity of a particular position. For example, if it has a low free float, that will limit the amount of trading that can potentially take place. It also makes it difficult to both enter and exit stock positions.

Generally, investors will prefer stocks with larger floats as it makes it easier for them to complete trades due to there being more available shares.