What is the Average Stock Market Return?

The average stock market return is a calculation that indicates how an index has performed over specific time frames. It gives investors an idea of the broad past performance and what they could potentially expect from the index over longer time horizons.

However, it’s important to note that even though an index may have delivered double-digit returns over several decades, the performance of individual years can vary enormously.

Techopedia Explains the Average Stock Market Return Meaning

The clearest average stock market return definition is that it’s a calculation that examines the returns generated over a specific period. It tells investors whether it has generally increased – or decreased – in the past and can help them decide whether it’s an attractive investment.

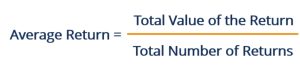

How is Average Stock Market Return Measured?

There is a basic calculation that can be made when you’re looking at the average returns of stock markets. This involves adding the annual returns over a set number of years – and dividing by the number of those years.

Let’s look at the annual returns of a hypothetical index – or asset.

| Year | Return |

| 2023 | 20% |

| 2022 | 15% |

| 2021 | 18% |

| 2020 | -10% |

| 2019 | 15% |

The annual average return would be (15% – 10% + 18% + 15% + 20%) divided by 5 = 11.6%

Historical Average Stock Market Returns

The average stock market returns by month can vary enormously – but it can be a similar story when it comes to an annual analysis.

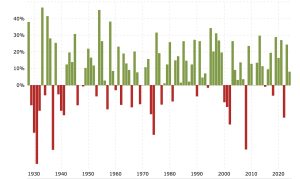

A prime example is the S&P 500 historical returns.

While the average annual return has been between 9% and 10% over recent decades, the performance of individual years has varied enormously.

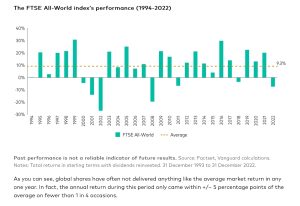

It’s why average stock market returns don’t always give a good picture of what you might receive in any one year, according to James Norton, head of financial planners at Vanguard Europe. “Market returns move around their averages from year to year – sometimes sharply, as in the case of shares,” he wrote. “But while shares tend to bounce around more than bonds and cash, they also tend to return more than bonds and cash over the long-term.”

He cited the performance of the FTSE All-World Index as an example. While the average annual return since 1993 has been 9.3% in sterling terms, it’s rarely delivered that figure in any one year.

Average Stock Market Returns and Inflation

Inflation, which measures how the prices of goods and services increase over time, can affect average stock market returns.

It can often have a negative impact, as inflation will make everything more expensive and potentially deter customers from buying. This will mean companies making less money.

Unfortunately, the relationship between inflation and average stock market returns isn’t always clear-cut because there are so many variables at play.

For example, if inflation is pushing up the price of something that customers have to buy – such as energy – then this can be a positive for companies involved in that sector.

However, the impact will also depend on whether firms have experienced an increase in the price of their costs.

Average Stock Market Returns and Volatility

Volatility is one of the most significant factors you’ll face when it comes to average monthly stock market returns. The definition of volatility is the extent to which the price of an asset fluctuates over time. Higher volatility implies there could be larger price swings.

The problem is that stock markets are notoriously volatile. You only have to look at the S&P 500 average return. Its best years have seen it return more than 30%. However, it lost almost 40% at its worst. In other periods it’s barely moved at all.

What Affects the Stock Market?

Many factors can influence stock markets.

Future Stock Market Growth Predictions

Economists, fund managers, and analysts will all have a view on the likely direction of stock markets over the next few years. They will reach these conclusions by examining the recent performance of shares. For example, has there been a strong rally?

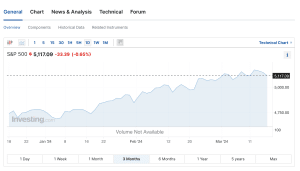

The S&P 500 is expected to finish this year above the 5,000 mark as it remains unclear when the Federal Reserve will begin cutting rates, according to a poll by Reuters.

The median forecast of 40 strategists suggested the benchmark US index will be at 5,100, which is roughly the level it’s reached in recent weeks.

The Bottom Line

While the average annual stock market return of the S&P 500 index is around 9% to 10%, it’s not been quite so clear cut over shorter time frames.

In some years, it’s increased by more than 30% up; in others, it’s down by almost 40%. There are also plenty of years where it’s barely moved at all. That’s why looking at the average stock market returns of an index should only give you a guide as to what’s happened in the past.

FAQs

What is the average stock market return in simple terms?

What is the average stock market return for the last 30 years?

What is a good average return on stocks?

What is the 20-year average return on the S&P 500?

References

- Average Return (Corporatefinanceinstitute)

- S&P 500 Index – 90 Year Historical Chart (Macrotrends)

- Why stock market returns are anything but average (Vanguardinvestor.co)

- S&P 500 to end 2024 with small gain after strong 2023: Reuters poll (Reuters)

- Investing.com – Financial Markets Worldwide (Investing)