What is the 2007–2008 Financial Crisis?

The global financial crisis, also known as the Great Recession, was the worst economic downturn in living memory. It was caused by a combination of increased subprime mortgage lending, excessive risk-taking by institutions, and the collapse of the US housing bubble.

Techopedia Explains the 2007–2008 Financial Crisis Meaning

Overall, the global financial crisis was a mess caused by risky loans, a housing market crash, and a chain reaction that hurt the economy worldwide. The consequences were devastating. Financial institutions collapsed, governments had to sanction multi-billion dollar bail-outs, and stock markets plummeted.

Although the recession technically lasted about 18 months, the financial effects were felt for many years and have also changed how investors view certain assets.

Causes of the Financial Crisis

Economists have argued for years over what exactly triggered the problems, but the most accurate 2007–2008 financial crisis definition is that it was due to several factors.

A crucial element was the increase in subprime mortgages, which involves lending to people with generally poor credit histories. Financial institutions were also taking on too much risk in this period, while there was also a bubble in the US housing market. This combination created a perfect storm.

Key Events of the Financial Crisis

For those trying to define the 2007–2008 financial crisis meaning, it’s important to look at the timeline of key events.

Early 2000s: US Housing Boom is Fuelled

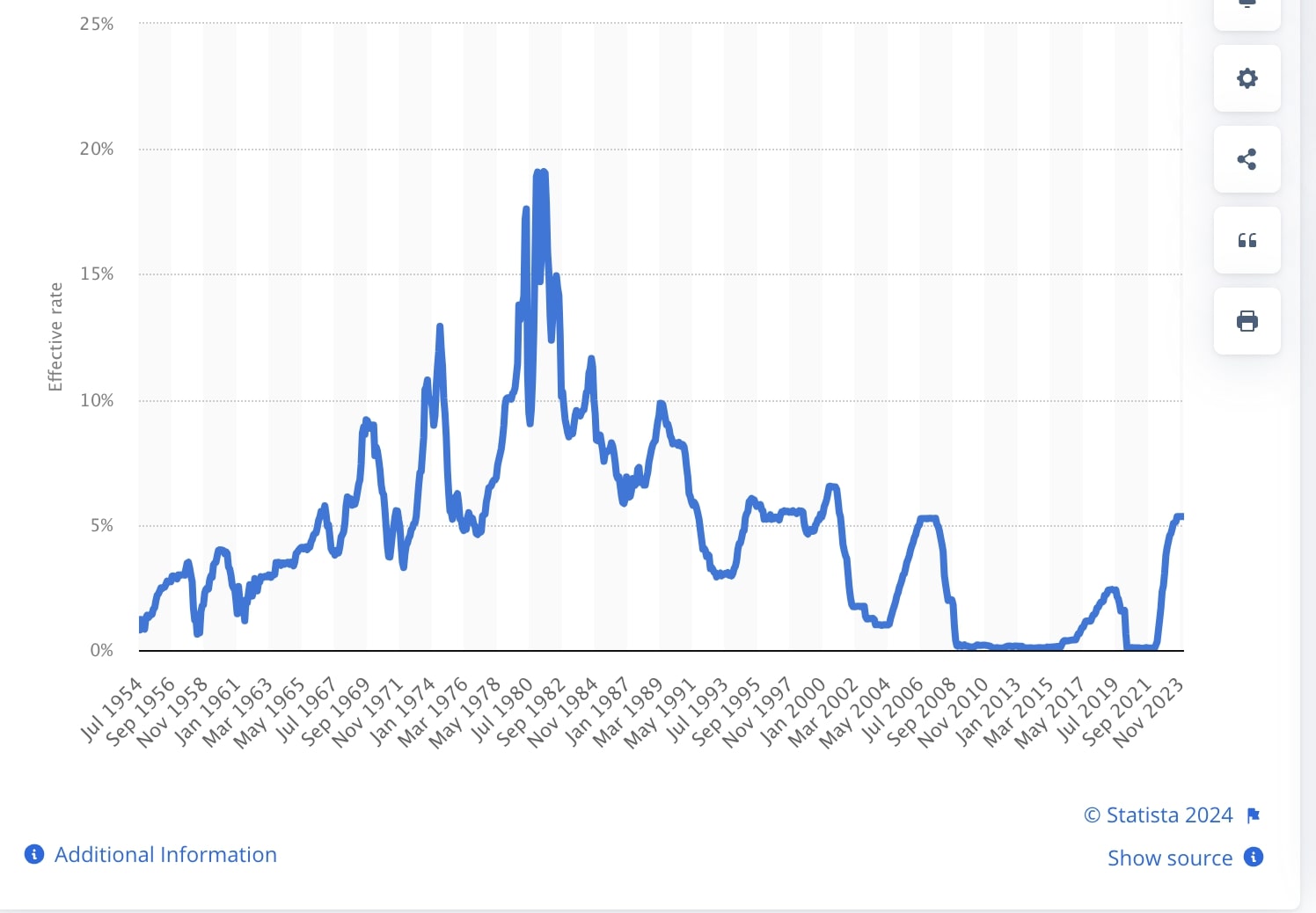

The US Federal Reserve cut interest rates in the early 2000s to help bolster the economy in the wake of the devastating dot.com crash. However, cheaper credit helped fuel a housing boom.

By mid-2003, long-term mortgage rates and the Federal Funds Rate had declined to levels not seen in a generation, according to a report from the Federal Deposit Insurance Corporation.

“One response to low-interest rates was an acceleration in US home price appreciation to double-digit rates for the first time since 1980,” it stated. This helped create the backdrop for the 2007–2008 financial crisis.

Source: Statista

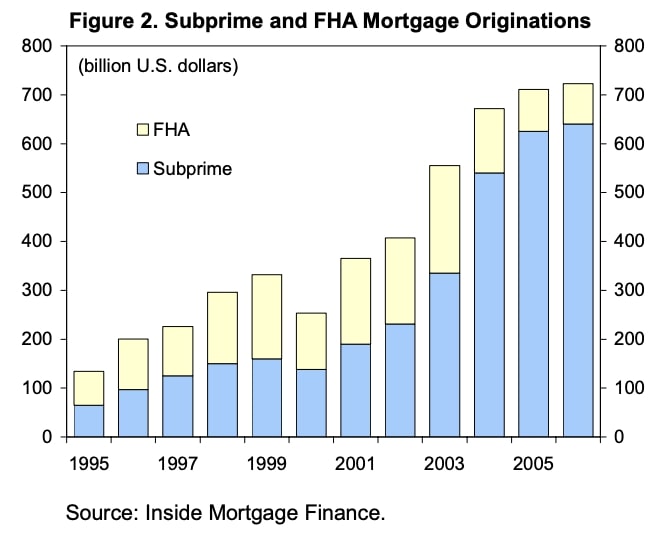

2000-2006: Boom in Subprime Mortgages

There was an increase in lending to borrowers who wouldn’t ordinarily be eligible due to factors such as poor credit histories, according to a report from the International Monetary Fund (IMF).

“Subprime mortgages are residential loans that do not conform to the criteria for “prime” mortgages, and so have a lower expected probability of full repayment,” it stated.

The IMF explained that subprime lending growth was boosted by more highly leveraged lending against a background of rapidly rising house prices.

“Housing affordability dropped to the point where a significant proportion of borrowers were financially overstretching via risky ‘affordability products’, with many apparently lying about their financial resources to get loans,” it explained.

Source: IMF

Early 2007: US Housing Bubble Bursts

US house prices fell significantly. The median price of an American single-family home fell for the first time in at least four decades, according to the National Association of Realtors.

The downturn prompts a collapse of the US subprime mortgage industry, according to a report by the Council on Foreign Relations, (CFR), a US think tank.

“More than twenty-five subprime lending firms declared bankruptcy in February and March 2007,” it stated. “The collapse rattles the Dow Jones Industrial Average, which measures the combined stock values of the thirty largest companies in the United States. On February 27, it lost 416 points, its biggest one-day point loss since 9/11.”

August 2007: The Problems Go Global

The realization started to kick in that the subprime issues could become a global problem as international banks and hedge funds revealed holdings in mortgage-backed securities.

In the UK, there was the first run on a British bank in 150 years after news broke that Northern Rock needed emergency support from the Bank of England.

Alistair Darling, the Chancellor of the Exchequer, announced the government would guarantee all deposits, according to an official report. “The financial crisis had started in earnest,” it stated.

The economic downturn is seen as having started in December 2007.

March 2008: Bear Stearns Hits Liquidity Problems

The US bank announces major liquidity problems and is granted a 28 day emergency loan from the New York Federal Reserve Bank. Shortly afterward, it was bought by JPMorgan Chase for $2 per share in a rescue deal backed by $30m of Fed financing, according to the CFR.

September 2008: Lehman Brothers Files for Bankruptcy

One of the most shocking developments came when the US bank, which was heavily exposed to the subprime mortgage market, filed for bankruptcy. The move triggered a global panic.

This was a significant moment, according to Harvard Business School.

“After Lehman Brothers declared bankruptcy in September 2008, approximately twenty-six thousand of the firm’s employees worldwide lost their jobs, and investors suffered immense losses, fueling the country’s greatest economic downturn since the crash of 1929,” it stated.

Late 2008: Emergency Support Measures Introduced

The last quarter of 2008 saw the recapitalization of banks by governments. For example, there was a $700bn bailout for the US banking industry, with $250bn used to buy stakes in banks.

The UK Government, meanwhile, injected £37bn of capital into Royal Bank of Scotland, Lloyds TSB, and Halifax/Bank of Scotland. There was also a coordinated rate cut by central banks, including the US Federal Reserve and the UK Bank of England, as part of monetary policy support.

Effects on the Financial Sector

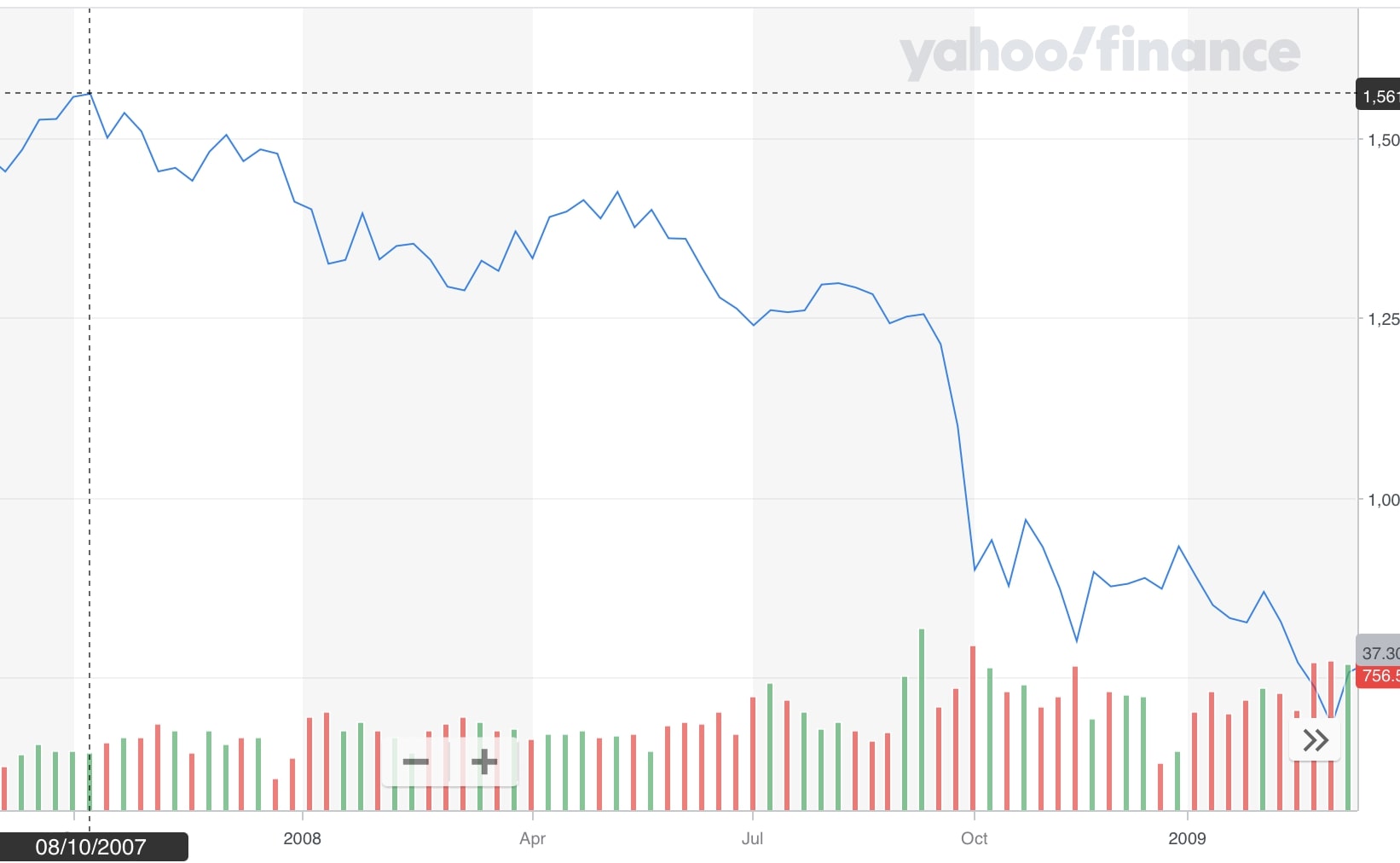

The fall-out from the financial crisis of 2008 wasn’t limited to the borrowers defaulting on their subprime mortgages, financial institutions, and the housing market. Global stock markets also plummeted in response to the crisis, and major businesses across the world started to fail, according to the Corporate Finance Institute.

“This, of course, resulted in widespread layoffs and extended periods of unemployment worldwide,” it stated. “Declining credit availability and failing confidence in financial stability led to fewer and more cautious investments, and international trade slowed to a crawl.” It’s why the 2008 stock market crash and economic downturn are often referred to as the Great Recession.

Source: Yahoo Finance

The financial crisis affected the ‘real’ economy and many countries experienced recession and falling asset markets. according to a report by the UK parliament’s House of Commons

“This caused further financial troubles in early 2009, prompting additional intervention by the authorities,” it stated. “After March 2009, there was an improvement in sentiment as markets stabilized and banks sought to raise capital and repair their balance sheets.”

Cost of the Financial Crisis

It’s hard to overstate the sheer economic cost of the 2008 financial crisis, according to the Harvard Business Review. “The combination of increased expenditures and decreased revenues resulting from the crisis from 2008 to 2010 is likely to cost the United States government well over $2trn, more than twice the cost of the 17-year long war in Afghanistan,” it stated.

The Federal Reserve Bank of San Francisco estimated the financial crisis represented a lifetime income loss of about $70,000 for every American. Although the recession ended in June 2009, economic weakness persisted, according to Federal Reserve History.

“Economic growth was only moderate – averaging about two percent in the first four years of the recovery – and the unemployment rate, particularly the rate of long-term unemployment, remained at historically elevated levels,” it stated.

Aftermath of the Financial Crisis

The road back to financial health started with the American Reinvestment and Recovery Act of 2009, which was enacted by the US Congress and signed into law by President Barack Obama.

This $789bn package, seen as a nationwide effort to create jobs and transform the economy, included investment in the nation’s infrastructure and introducing tax cuts.

The world felt the effects of the financial crisis for many years, according to a report published in 2018 by Mckinsey & Company. “The road to recovery has been a long one since those white-knuckle days of September 2008,” it stated. “Historically, it has taken an average of eight years to recover from debt crises, a pattern that held true in this case.”

The study pointed out that central banks, regulators, and policy makers were forced to take extraordinary measures after the 2008 crisis. “As a result, banks are more highly capitalized today, and less money is sloshing around the global financial system,” it concluded.

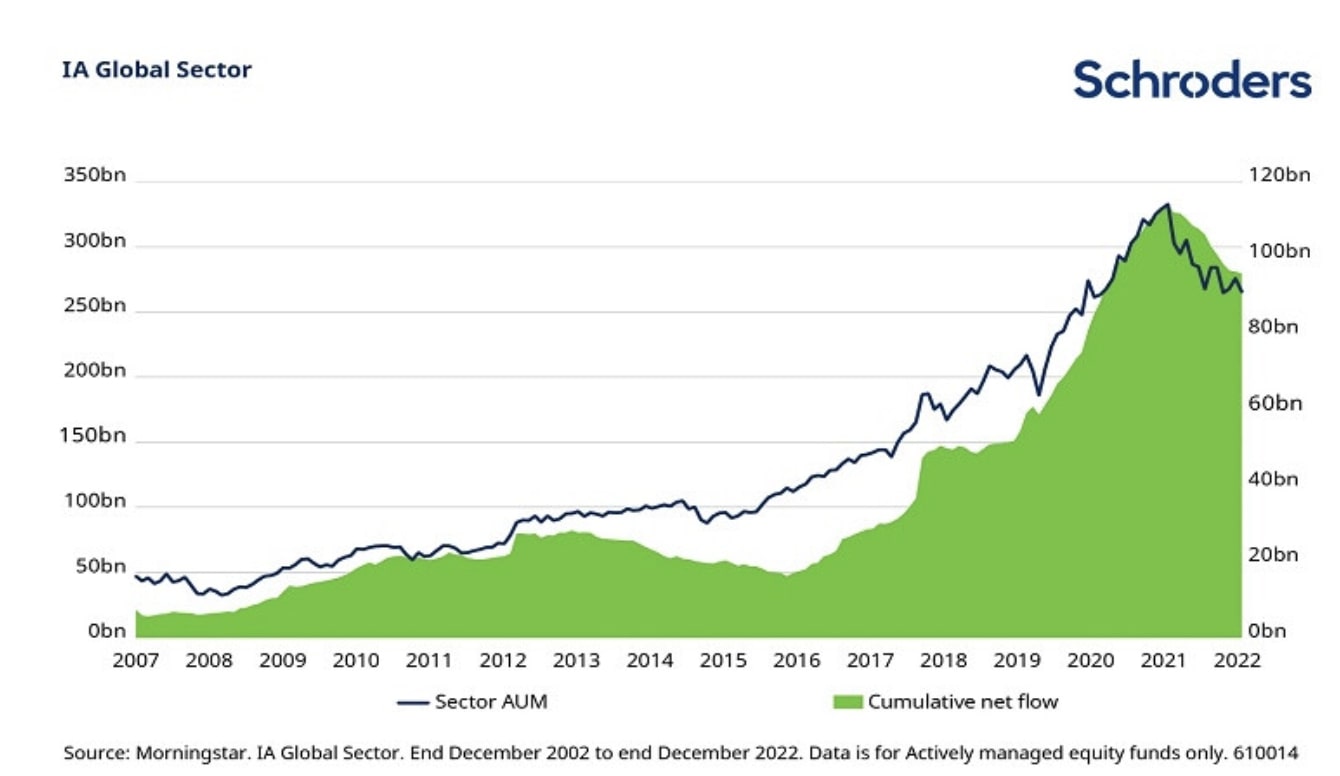

A Different Outlook

More broadly, the financial crisis has also changed how investors act. There’s certainly been a shift in the mindsets of UK investors, according to a report by Schroders. “The domestic bias has been turned on its head, with substantial outflows from the IA UK All Companies sector, while the IA Global sector has grown exponentially,” it stated.

Assets under management in the IA Global equity sector rose from £11.7bn in 2008 to £266bn in 2023, it noted, while those in the UK All Companies sector had fallen £2bn to £95bn.

Source: Schroders

The Bottom Line

The Great Recession was a financially devastating period for the global economy and one from which it took many years to properly recover.

Starting in the US, it quickly spread to other countries and resulted in the collapse of financial institutions, large-scale government bail-outs, and plummeting stock markets. While the recession lasted around 18 months, the world felt the longer-term financial effects of the 2007–2008 financial crisis for many years.

FAQs

What is the 2007-2008 financial crisis in the short terms?

What caused the 2007-2008 financial crisis?

How was the 2008 financial crisis solved?

How long did the 2007 financial crisis last?

References

- Origins of the Crisis (FDIC)

- Monthly Federal funds effective rate in the United States from July 1954 to February 2024 (Statista)

- Money for Nothing and Checks for Free: Recent Developments in U.S. Subprime Mortgage Markets (IMF)

- Home Prices Fell in ’07 for First Time in Decades (NYTimes)

- 1992 – 2018: The U.S. Financial Crisis (CFR)

- Bank rescues of 2007-09: outcomes and cost (UK Parliament)

- The Great Recession (Federalreservehistory)

- Global Impact of the Collapse (HBS)

- Financial Crisis Timeline (UK Parliament)

- 2008-2009 Global Financial Crisis (Corporate Finance Institute)

- S&P 500 (Yahoo Finance)

- The Social and Political Costs of the Financial Crisis, 10 Years Later (HBR)

- The Great Recession and Its Aftermath (Federal Reserve History)

- The American Reinvestment and Recovery Act: Jumpstarting our Economy and Investing in Our Future (Senate.gov)

- A decade after the global financial crisis: What has (and hasn’t) changed? (McKinsey)

- 15 years since Lehman’s: from 5% to 0.25% and back (Schroders)